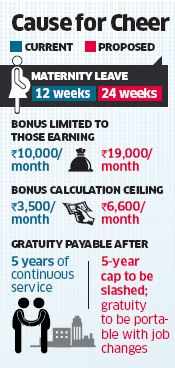

Labour law recast to add more leave to maternity, gratuity to be made portable

NEW DELHI: The Narendra Modi-led NDA government is looking to enhance

maternity leave for working women from three months to six months

, virtually double bonus payments to employees and make gratuity portable

between jobs. These proposed changes in employment laws could

buttress the Modi government's credentials with the working class while

it attempts to push through more ambitious reforms in labour rules

that are blamed for hampering investment and job creation in the country.

maternity leave for working women from three months to six months

, virtually double bonus payments to employees and make gratuity portable

between jobs. These proposed changes in employment laws could

buttress the Modi government's credentials with the working class while

it attempts to push through more ambitious reforms in labour rules

that are blamed for hampering investment and job creation in the country.

"The changes in the Payment of Bonus Act would raise the salary limit for

getting a bonus from Rs 10,000 per month to Rs 19,000, and are at

an advanced stage with a draft Cabinet note being moved earlier

this month for comments from ministries," said a senior labour ministry

official. Separately, the government is initiating stakeholder consultations

to amend the Maternity Benefits Act of 1961 and the Payment of Gratuity

Act of 1972, the official added.

Currently, companies are legally required to grant 12 weeks of maternity

leave to employees though several leading employers offer additional

time off and other benefits. For instance, Accenture offers five months

off to new mothers while Flipkart offers 24 weeks paid leave. Citibank

also offers a creche allowance to new mothers, as do some other

multinational firms and investment banks.

"The ministry of women and child development has been pursuing

this with us extensively as it is primarily responsible for women's welfare

so we are framing a proposal to kick off talks with employers

and trade unions on enhancing the maternity leave to 24 weeks

" the official said. One option being considered is to limit the enhanced

maternity leave to two children and an employee having a third child

would be granted 12 weeks off, in line with the present norm.

REDUCTION IN 5-YEAR ELIGIBILITY

Similar tripartite discussions are also being

Similar tripartite discussions are also beinglaunched on amending the gratuity law to do

away with the requirement that employees

serve at least five years in a single workplace

to be eligible for the benefit.

Employee representatives have been seeking

a reduction in the five-year continuous service

clause to qualify for gratuity and the social security

committee of the Indian Labour Conference

had endorsed the idea in May 2013.

"While we are examining the possibility of

reducing the five-year eligibility for gratuity

benefits, this requirement would be redundant

if we allow gratuity to be transferred from

one job to another. So we are looking at both

the options," the official said.

The Payment of Bonus Act of 1965, expected

to be the first of the three laws for which amendments

will come up for the Cabinet's consideration

, sets two numerical ceilings for limiting bonus payouts

to workers.

All employees earning up to Rs 10,000 a month are eligible for a minimum bonus

of 8.33% of their annual salary and a maximum of 20%. This ceiling takes into

account any productivity-linked bonus that employers may offer.

The Rs 10,000 salary cut-off is only used for eligibility purposes and actual bonus

payments are linked to a separate 'calculation ceiling'. Bonus payments for anyone

earning more than Rs 3,500 a month are made assuming his or her salary

is Rs 3,500 per month . Both these thresholds were last revised in 2006.

After tripartite consultations with employers and employees yielded no

consensus late last year, the government had referred the Bonus Act

amendments to an inter-ministerial group that has now recommended

both thresholds be raised in line with changes in the consumer price

index since 2006.

The new ceilings under the Bonus Act are likely to be Rs 19,000 per

month (salary limit for eligibility) and Rs 6,600 (salary limit for bonus calculation purposes).

No comments:

Post a Comment